Several dealers from MX came up to one of the PTO2 events, and by the end of the day they were asking the Central/South America rep how many they could order... immediatelyIts my understanding that Mexico, Central & South American dealers are next on the expansion list. I expect the dealership in Medellín will be quite busy.

The Grenadier Forum

Register a free account today to become a member! Once signed in, you'll be able to contribute to the community by adding your own topics, posts, and connect with other members through your own private inbox! INEOS Agents, Dealers or Commercial vendors please contact admin@theineosforum.com for a commercial account.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Land Rover feeling the Heat?

- Thread starter Norb-TX

- Start date

-

- Tags

- land rover

Considering the D110 owners have their own Land Rover club in Tijuana, I wouldn't be surprised at all. One of the G owners at the desert run recently was from TJ.Several dealers from MX came up to one of the PTO2 events, and by the end of the day they were asking the Central/South America rep how many they could order... immediately

JLR Australia have managed to sell 1042 vehicles YTD 2024 (2 months) across all models.

Defender is the largest selling model with about 40% of that number.

Considering SUV's and utes ake 6 of the top 10 vehicles sold in Australia that is rubbish.

They are number 25 brand in the market

Even Porsche have sold more vehicles YTD than they have.

Mind you they smashed Jeeps total sales of 495 vehicles across all models.

Defender is the largest selling model with about 40% of that number.

Considering SUV's and utes ake 6 of the top 10 vehicles sold in Australia that is rubbish.

They are number 25 brand in the market

Even Porsche have sold more vehicles YTD than they have.

Mind you they smashed Jeeps total sales of 495 vehicles across all models.

Socal dealer I spoke to in January claimed he’s selling 30 per month so far.

I believe Ineos Brisbane delivered 30 Grenadiers in FebruarySocal dealer I spoke to in January claimed he’s selling 30 per month so far.

Who knows.

I am sure Ineos is more financially-savvy than me; my guess is a split in Grenadier's execution levels could be beneficial.

At present, the Grenadier (baseline version, starting at $71.5k in the U.S.) is a really, really basic vehicle, lacking refinement many other 4x4s in the States have. Pushing the baseline price down to Wrangler- and Bronco-comparable levels could draw in a huge market. I don't see a bright future for the Quartermaster - tens of thousands of Gladiators are gathering dust at Jeep dealerships.

Ok, let's assume 80k for a Grenadier with a relative high margin of 15% (more than Tesla, Mercedes, BMW but less than Ferrari (24%)). That would mean 12k per car. Using this number they have to sell 125.000 cars to earn 1,5 billion, roughly the estimated development costs (while another car is developed and generates costs). However, costs continue to drop in....

The remaining 68k are for the production costs, supply, salaries, accruals (you have to build up accruals for warranty stuff and other things), marketing, dealer provision, etc. Parts of that have to be reinvested immediately to keep the cash flow up and to buy new supply parts.

We know that there are a lot of costs regarding warranty, I just need to think about the Ineos teams running around to swap gear boxes etc. and the bills the dealers write for their warranty work (and provisions etc). And if I look at Ineos's marketing, all these journeys all over the world, the high quality videos etc. I assume that will also cost some bucks.

And here we come to an important point. As the sales are far behind the expectation (at least in Europe) the following issues pop up. A car manufacturer backs up its production by contracts. If Ineos has signed contracts for far more units than sold, they still have to pay for the parts and get them delivered. Why? Because the suppliers, maybe except a few big ones like BMW, need to get bank credits for new tools, machines and their supply parts to get the production up and running and feed. Every part which is not a standard produced for other cars, as well, is an individual invest for the supplier.

I give a few examples:

Kayser: Fuel System

Eberspächer: Parts of the Exhhaust System

Cohline: Gearbox Cooling

IBS Filtran: Oil related parts for the gearbox

Edscha: Door parts

CIE Automotive: Sunroof

Gestamp: Ladder frame and more

And more, like Helag, Stocko, Delfingen, Recaro, Hirschmann....

Usually a car manufacturer ends up +/-15% of the expected sales numbers covered in a contract and the contract includes such variations. So all involved parties, suppliers, their banks and even the banks giving liquidity to Ineos look at the performance. To build what? Trust. And as the Chemical business, a big part of the financial backup for the project, I assume (as at least 2020 470 Millions were transferred from Chemical to Automotive) also this performance is closely monitored and as we know, that performance is lacking since 2023 because of the overall economy issues.

Two years ago I visted a mid size company doing metal work. They were in the process of installing three CNC milling machines, each one big as a living room which costs millions. These were bought for a big VW order. Both sides, of course, cover each other, so this company could be sure to sell as many parts to VW to get this invest payed. And why? because of trust in a big brand and a signed contract which is trustworthy. No one incl. the banks expect VW to fail and breach the contract.

So it is crucial to generate trust and trust comes from reliability (not of the car but regarding the acting and performance). If the numbers are right, everbody feels comfortable. Trust usually takes years to build up or you have good collaterals.

AWo

Last edited:

55 commercial and 8 normal. Smmt data. I think my local dealer had delivered c 80 since launch.8 cars in February is not enough. 20 odd Dealers/Agents cannot survive selling this number. I am guessing 24 plate may mean more sales ( I hope). If not the the car will die.

NB: I have just noticed that the 0% deal in the UK has been extended to March 31st.

I think the number was mid 60s not 8.LR are laughing I would say. In the UK in February there were 0% deals and a total of 8 Grenadiers were sold! That is 8!

I thought the NA reservations were over 9000. I thought it was posted somewhere that the average number of trucks per dealer was around 550. 1 dealer in southern California had over 700 reservations allotted to them. There is also so many trucks a dealer can deliver. Mine hasn't even gotten to 100 deliveries yet.Market saturation may be one thing, but turning their attention to North-American market may be another giant reason. I don't know what the numbers of monthly registrations are in the U.S., guess in mid-400s. They had 7000 reservations prior to start of sales.

Hope you are right, but the SMMT website says otherwise: https://www.smmt.co.uk/vehicle-data/car-registrations/I think the number was mid 60s not 8.

It will be interesting to see how many potential buyers in Australia have held off buying a Grenadier in anticipation of the Quartermaster arriving. The Quartermaster could be the vehicle for Ineos that generates an increased awareness of the brand and a significant sales increase in Australia.

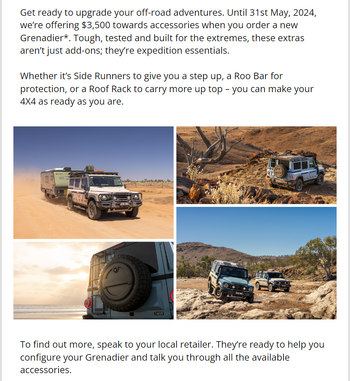

On a side note Ineos has sent an email offering AU$3500 in accessories for a new order.

On a side note Ineos has sent an email offering AU$3500 in accessories for a new order.

This cost has been the issue from the beginning. The defender, while quite capable with its tech, went upmarket. The gren was supposed to trend the opposite, in both tech and price. It was going to be cheaper. Get less, pay less.Ineos has increased the price without offering more. That is something which doesn't work for customers. Customers are willing to pay less for the same or pay the same for more or pay more for more. I do not talk about absolue enthusiasts, like we can all see here. But that is a far too small customer base for a complete new development of a car. I told guys from Ineos once, to start cheap (I saw end of 40k, beginning of 50K), with low entrance models and to give the customer the chance to upgrade (at their will) and to have potential for Ineos upgrades (with price increases) and facelifts, etc. to justify an increased price. But they decided to jump in at a very high price. Then they increased the price without offering more (and at the same time firefighting a lot of problems). So where is room for improvement without going far over 100K? And will that mean another price increase?

The Defender starts 10g less than the gren, and it does give you more. The non enthusiast that is needed to make up the bulk of the sales isn't showing up for more money and less car. The "D" does reach parity at the top when optioned, but it still gets the lower end mid 60's volume that the Gren is completely locked out of. The geleandewagen already has the "more money than I need" crowd, and they expect nicer trim anyway. Ineos kinda hung it out there in a never never land. If this volume makes money, and keeps the dealers happy, It's not a big deal. If not, then a storm is brewing.

Considering the tech, fit and finish the Defender has, I really do think it was possible for the gren to hit the 50-55g starting price with a more concerted effort to choose parts, and design the coach, for the targeted cost. More GM and Dana, and less BMW and Magna. I couldn't have been the only one that raised eyebrows when some of the suppliers were announced. This "inflation" excuse is foolish. Every company has the same issue, so the relative target never moved. What happened was "brandflation", with the oem manufacturers. The Gren really is an awesome truck but... It's not a plebeian 4x4.

Time will tell!

Thats irritating.It will be interesting to see how many potential buyers in Australia have held off buying a Grenadier in anticipation of the Quartermaster arriving. The Quartermaster could be the vehicle for Ineos that generates an increased awareness of the brand and a significant sales increase in Australia.

On a side note Ineos has sent an email offering AU$3500 in accessories for a new order.

View attachment 7847368

Logisticsflation of shipping parts across the globe when they can be sourced on the continent and trucked around would have lead to higher prices and increased the delayflation given COVID era supply chain issues.This cost has been the issue from the beginning. The defender, while quite capable with its tech, went upmarket. The gren was supposed to trend the opposite, in both tech and price. It was going to be cheaper. Get less, pay less.

The Defender starts 10g less than the gren, and it does give you more. The non enthusiast that is needed to make up the bulk of the sales isn't showing up for more money and less car. The "D" does reach parity at the top when optioned, but it still gets the lower end mid 60's volume that the Gren is completely locked out of. The geleandewagen already has the "more money than I need" crowd, and they expect nicer trim anyway. Ineos kinda hung it out there in a never never land. If this volume makes money, and keeps the dealers happy, It's not a big deal. If not, then a storm is brewing.

Considering the tech, fit and finish the Defender has, I really do think it was possible for the gren to hit the 50-55g starting price with a more concerted effort to choose parts, and design the coach, for the targeted cost. More GM and Dana, and less BMW and Magna. I couldn't have been the only one that raised eyebrows when some of the suppliers were announced. This "inflation" excuse is foolish. Every company has the same issue, so the relative target never moved. What happened was "brandflation", with the oem manufacturers. The Gren really is an awesome truck but... It's not a plebeian 4x4.

Time will tell!

I think sourcing European manufacturers was prudent.

Every car manufacturer (or any large apparatus) is moving vast quantities of parts from all over the globe all the time. At this scale it's all about volume, and cost to manufacture. About the only instance I can think where local may make a huge difference, is if your production process is JIT as opposed to warehousing. In which case any downtime due to a shipping issue disruption, which is what happened during covid, can be problematic. Covid is just not the norm though, and losing profit for 10 years to avoid a covid situation and be "secure" is good way to go out of business. Besides, even if you can build cars when no one else can, doent mean you'll sell them when the rest of the globe is in a recession. A big reason manufacturers build pants worldwide that make the same product, is currency exchange rates.Logisticsflation of shipping parts across the globe when they can be sourced on the continent and trucked around would have lead to higher prices and increased the delayflation given COVID era supply chain issues.

I think sourcing European manufacturers was prudent.

Depends how you see it. New Defender is a Discovery 5 with different body. Bad engines, especially the 2,0 diesel is a catastrophy. For off-road suspension is bad and computer programming makes it impossible to drive (at least in conditions I have been able to test it). Should not be compared to IG the same day.The Defender starts 10g less than the gren, and it does give you more.

This is fully true. I was expectiong a robust work vehicle. Powertrain and chassis are great except the lack of manual transmission. But everything else is far too complicated, computerized and expensive.Considering the tech, fit and finish the Defender has, I really do think it was possible for the gren to hit the 50-55g starting price with a more concerted effort to choose parts, and design the coach, for the targeted cost.

My opinion is: It seems that the Grenadier will or has in a short time satisified the 4x4 enthusiasts scene....and there is no modell to compensate if its entry into the normal consumer market will run not so well....add the problems and it may explain the situation.

View attachment 7842982

I am not certain we may draw such a conclusion based on data that is out of context. The conclusion may be correct, but there will be other factors contributing.

The graph above does show a reduction in sold units beginning in December 2023 - but only for Germany. December 2023 (or thereabouts) is also the start of deliveries to the U.S. market for two years worth of outstanding orders. Leading up to this time (Dec 2023) Ineos made clear that once U.S. deliveries began, long wait times would ensue in all other markets. We may surmise that, due to lack of manufacturing capacity, there would be little available inventory sitting on dealer lots as well. Is that not the case in the EU, SA, and possibly Australia?

Long wait times will always depress purchase orders unless high demand has been created through advertising which, in my opinion, Ineos has done poorly. Yes, they have created buzz for the enthusiasts and "freaks" but not for the general buyer. That requires targeted advertising tailored to each market (at least a half dozen in the U.S. alone) via television, the internet, print, etc. Is that happening anywhere? I've seen nothing here. The "less-Freaky" need to know the vehicle exists and why they need it or they will buy an approximation because the competition's advertising has presented it to them on a platter.

We may forgive Ineos this underwhelming promotional effort as they are a small company and they've obviously been busy developing yet another model. That says to me that they are trying to fill the gaps as quickly as possible. A risky strategy to be sure - to be bringing to market three new models within three years without a bonafide success under their belts.

But you need Yummie Mummies for the sales numbers....

For the advertising to be effective there has to be product on the floor. Sugar Daddies don't order vehicles for their Yummy Mummies a year in advance. They pop down to the dealer and buy off the lot. Deep and varied inventory needs to be ready and waiting. I bet we're a year out from that at least.

That's perfectly understandable - getting California-legal ROW 110 cost close to the brand new Grenadier, and you can only insure it for KBB value.I thought the NA reservations were over 9000. I thought it was posted somewhere that the average number of trucks per dealer was around 550. 1 dealer in southern California had over 700 reservations allotted to them. There is also so many trucks a dealer can deliver. Mine hasn't even gotten to 100 deliveries yet.

Yes, these are just the German numbers, but that Ineos hasn't reached 50% of the desired numbers applies globally. The German and also the British numbers just reflect that, at least up to today. It may change to the better...I am not certain we may draw such a conclusion based on data that is out of context. The conclusion may be correct, but there will be other factors contributing.

AWo

Come June dealers should be caught up and it will be nice to see actual NA sales numbers. From what I’ve read on this forum, 2024 production has been fully booked and new orders are for 2025 MY.

Similar threads

- Replies

- 16

- Views

- 778

- Replies

- 2

- Views

- 229

- Replies

- 8

- Views

- 1K