Hi

I am new on here and sorry if this has been answered elsewhere, but I couldn't see anything.

Has anyone got a definitive answer as to how are the Ineos Grenadier Commercial variant 2 and 5 seat models classed with the UK HMRC in relation to BIK?

Ineos has stated the commercials are both N1 and as such are light goods vehicles or vans. I know however HMRC live in their own little world. Would be nice if HMRC also maintained an up-to-date list of all N1 type vehicles (pre-OEM alterations) and how they deem then in HMRC land, with out the grey mist the cover everything in.

I called HMRC and asked them and one of their call handlers after asking the question came back with that they are vans, but I'm sure that conversation would vanish like ice does on a hot day if it had to.

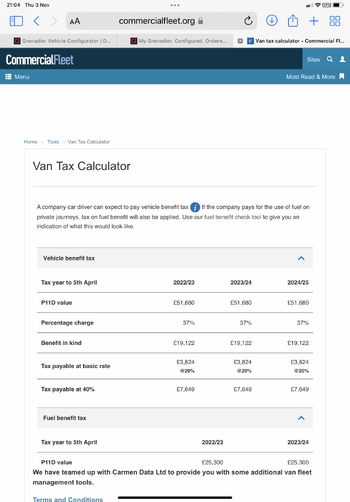

Basically are they down as a van with the fixed BIK value (£3,600) or are they based on their value and emissions as a car is?

Any past experience, pointers or advice would be greatly appreciated.

Thanks in advance

Olly

I am new on here and sorry if this has been answered elsewhere, but I couldn't see anything.

Has anyone got a definitive answer as to how are the Ineos Grenadier Commercial variant 2 and 5 seat models classed with the UK HMRC in relation to BIK?

Ineos has stated the commercials are both N1 and as such are light goods vehicles or vans. I know however HMRC live in their own little world. Would be nice if HMRC also maintained an up-to-date list of all N1 type vehicles (pre-OEM alterations) and how they deem then in HMRC land, with out the grey mist the cover everything in.

I called HMRC and asked them and one of their call handlers after asking the question came back with that they are vans, but I'm sure that conversation would vanish like ice does on a hot day if it had to.

Basically are they down as a van with the fixed BIK value (£3,600) or are they based on their value and emissions as a car is?

Any past experience, pointers or advice would be greatly appreciated.

Thanks in advance

Olly

Last edited: