Hi I believe that the grenanider does not have a one tonne pay load and there for does not allow you to reclaim the vat and bik which if this is right and at the moment nobody can tell me different then I think ineos has made a big cock up for business users. I was also asked for the vat number

The Grenadier Forum

Register a free account today to become a member! Once signed in, you'll be able to contribute to the community by adding your own topics, posts, and connect with other members through your own private inbox! INEOS Agents, Dealers or Commercial vendors please contact admin@theineosforum.com for a commercial account.

UK & Ireland VAT specifically on Station Wagon versions only & VAT in UK

- Thread starter Jameshurrell

- Start date

-

- Tags

- vat

Hi James,

Firstly I have no direct or qualified knowledge of the tax implications but in my opinion the carrying payload does not need to be 1 Tonne plus.

If you think about the basic fact that this is a ‘car derived van’ such as any unnumbered of small vans around that do not carry 1 tonne. Plus it is registered as a commercial N1.

I also understand that there are rules which define a commercial vehicle as having more load space than passenger space. This is why the five seat version has the rear seats further forward.

VW Transporter type vehicles with extra seats have a bit of a grey area here.

The two seat has no issues with that aspect.

So the Vat reclaim aspect should be straightforward I believe.

BIK is not something I have much experience of but ought to follow similar lines of other similar vehicles?

Regards,

A.

Firstly I have no direct or qualified knowledge of the tax implications but in my opinion the carrying payload does not need to be 1 Tonne plus.

If you think about the basic fact that this is a ‘car derived van’ such as any unnumbered of small vans around that do not carry 1 tonne. Plus it is registered as a commercial N1.

I also understand that there are rules which define a commercial vehicle as having more load space than passenger space. This is why the five seat version has the rear seats further forward.

VW Transporter type vehicles with extra seats have a bit of a grey area here.

The two seat has no issues with that aspect.

So the Vat reclaim aspect should be straightforward I believe.

BIK is not something I have much experience of but ought to follow similar lines of other similar vehicles?

Regards,

A.

Hi J

VAT reclaim has nothing to do with the type of vehicle, but whether you have a VAT registered business AND you are using the vehicle for the business (at least in theory). When the business purchases the vehicle, it can "reclaim" the VAT, simply because VAT is not a corporate but an enduser tax - Well, "reclaiming VAT" is commonly used but not quite correct, you are offsetting your "input" VAT" against your "output" VAT, monthly, quarterly or yearly.

No business pays VAT, its merely collecting the VAT of the value it added to the goods for the taxman. For a vehicle that is a bit abstract now, because you are not buying it to sell it like your merchandise, however, the vehicle is required for the generation of revenue for the business (and therefor part of the VAT regime for the business).

Whilst we are at it from a tax and accountancy perspective, you want to look at the end of the lifespan of the truck within the business, provided it has been taken on the books and not being leased. A lot of money can be lost here:

Every year (typically over a period of 5-8 years) you are depreciating the truck in the books, either linear (a set percentage of the purchase price) and preferable to the degressive method (a set percentage of the remaining value), unless you have to or want to depict a more realistic value. Say, you depreciate the truck by 20% over five years, it is worth 1 in your books after that time (0is nothing and the vehicle is still there). Since it commands 20k on the second hand market, you are netting 19.999 extraordinary revenue for the business. Some countries require you to tax that at full whack, others allow you, to re-invest that into your business in a tax neutral manner.

Either way, once the commodity (the truck) has been fully depreciated, it should be sold, because depreciation is cost, i.e. your earnings will increase w/o these cost and you pay more tax at year end. It has been common practise for businesses to sell their depreciated commodities at a much lower prices then their market worth - and finding an alternative solution for the difference.

There is another pitfall with the taxman: some countries and their tax regimes regard a truck as being used 100% for the business, always, whereas a car could be used privately - with that portion being taxed separately at a set rate (BIK). Should you need to be driving a car, not wanting to pay BIK, you could prove through a logbook, that the vehicle is being used exclusively for the business - which is tideous and too much hassle for many folk. From a business perspective, registering a 4x4 a truck instead of a car is usually a good idea.

To round things up, some countries have a VRT, a vehicle registration tax, which can be hefty. Trucks of certain categories might be exempt or charged at a reasonable flat rate of a few hundred bucks, as opposed to the top rate, which can be as much as 45% of the retail price.

Hi James,Hi I believe that the grenanider does not have a one tonne pay load and there for does not allow you to reclaim the vat and bik which if this is right and at the moment nobody can tell me different then I think ineos has made a big cock up for business users. I was also asked for the vat number

VAT reclaim has nothing to do with the type of vehicle, but whether you have a VAT registered business AND you are using the vehicle for the business (at least in theory). When the business purchases the vehicle, it can "reclaim" the VAT, simply because VAT is not a corporate but an enduser tax - Well, "reclaiming VAT" is commonly used but not quite correct, you are offsetting your "input" VAT" against your "output" VAT, monthly, quarterly or yearly.

No business pays VAT, its merely collecting the VAT of the value it added to the goods for the taxman. For a vehicle that is a bit abstract now, because you are not buying it to sell it like your merchandise, however, the vehicle is required for the generation of revenue for the business (and therefor part of the VAT regime for the business).

Whilst we are at it from a tax and accountancy perspective, you want to look at the end of the lifespan of the truck within the business, provided it has been taken on the books and not being leased. A lot of money can be lost here:

Every year (typically over a period of 5-8 years) you are depreciating the truck in the books, either linear (a set percentage of the purchase price) and preferable to the degressive method (a set percentage of the remaining value), unless you have to or want to depict a more realistic value. Say, you depreciate the truck by 20% over five years, it is worth 1 in your books after that time (0is nothing and the vehicle is still there). Since it commands 20k on the second hand market, you are netting 19.999 extraordinary revenue for the business. Some countries require you to tax that at full whack, others allow you, to re-invest that into your business in a tax neutral manner.

Either way, once the commodity (the truck) has been fully depreciated, it should be sold, because depreciation is cost, i.e. your earnings will increase w/o these cost and you pay more tax at year end. It has been common practise for businesses to sell their depreciated commodities at a much lower prices then their market worth - and finding an alternative solution for the difference.

There is another pitfall with the taxman: some countries and their tax regimes regard a truck as being used 100% for the business, always, whereas a car could be used privately - with that portion being taxed separately at a set rate (BIK). Should you need to be driving a car, not wanting to pay BIK, you could prove through a logbook, that the vehicle is being used exclusively for the business - which is tideous and too much hassle for many folk. From a business perspective, registering a 4x4 a truck instead of a car is usually a good idea.

To round things up, some countries have a VRT, a vehicle registration tax, which can be hefty. Trucks of certain categories might be exempt or charged at a reasonable flat rate of a few hundred bucks, as opposed to the top rate, which can be as much as 45% of the retail price.

Last edited:

Very specific about the model - the Station Wagon.

There have been quire a few delivered and many will have been company purchases.

Curios to know what the status of these and how different Accountants have viewed what can and cannot be claimed.

Has anyone successfully reclaimed or even submitted their VAT to reclaim the VAT?

Can anyone clarify what the classification on the V5 is?

Thx Tony

There have been quire a few delivered and many will have been company purchases.

Curios to know what the status of these and how different Accountants have viewed what can and cannot be claimed.

Has anyone successfully reclaimed or even submitted their VAT to reclaim the VAT?

Can anyone clarify what the classification on the V5 is?

Thx Tony

You can reclaim VAT but it needs to be a pool car, ie used by more than one employee. If its just for one employee its classed as a car and there is no reduced BIK benefit. So it would be very expensive to have it assigned to one employee.

If you buy the Commercial version the BIK is fixed at £700 and you can claim VAT and tax on the purchase.

Not sure about the law on the five seat Commercial version. l think that it needs to have a payload of over 1 tonne to be classed as a Commercial Vehicle

Not sure about the law on the five seat Commercial version. l think that it needs to have a payload of over 1 tonne to be classed as a Commercial Vehicle

- Local time

- 7:25 PM

- Joined

- Jul 27, 2022

- Messages

- 6,005

Do you mean Taxation Class?Very specific about the model - the Station Wagon.

Can anyone clarify what the classification on the V5 is?

If so, it's recorded as Light Goods Vehicle on mine.

I asked about the station wagon as when ordered it was a specific model. It was a 5 seater and could be had with side panels or glass.

My truck has a taxation class of Light Goods Vehicle so am asuming the Greadier will follow the same tax and vat rules.

Thats good news!

My truck has a taxation class of Light Goods Vehicle so am asuming the Greadier will follow the same tax and vat rules.

Thats good news!

- Local time

- 2:25 PM

- Joined

- Dec 28, 2021

- Messages

- 860

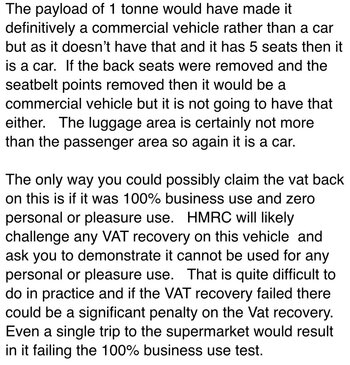

I have a Utility 5 seat station wagon - the DVLA say it is a "Commercial" and the RFL reflects that. HMRC march to a different drum and consider it to be a car. If you are relying on it being a van for BIK and the VAT reclaimable, I suggest you get formal, paid advice from someone you can sue if they are wrong.

As of tonight following advice( see attachment )from my accountant, negative reviews for Harry Metcalfe and worries about support when I’m 150 miles from the agent I have sadly asked for my deposit back . I wish the project well if only to prove to JLR that they were wrong to dump the old defender.I have a Utility 5 seat station wagon - the DVLA say it is a "Commercial" and the RFL reflects that. HMRC march to a different drum and consider it to be a car. If you are relying on it being a van for BIK and the VAT reclaimable, I suggest you get formal, paid advice from someone you can sue if they are wrong.

Attachments

I have had similar advice re VAT. Sadly it turns a 50k car into a 60k van. Would be used as a farm vehicle part of the time. Can see me cancelling my order. There must be almost 10% of deliveries on auto trader so don't think we are alone.

This is a problem for me as well. l've currently got a Defender Commercial which is okay as it's only a 2 seater.

However l can't claim the VAT back anyway because l am not VAT registered.

I can claim the tax back on the purchase price of £55,000.

BIK is £700 PA

The law on five seat commercials is a bit complicated, l don't think the Grenadier qualifies.

The govt changed the rules to try and close a loophole on people buying double cabs and getting away with company car tax etc.

However l can't claim the VAT back anyway because l am not VAT registered.

I can claim the tax back on the purchase price of £55,000.

BIK is £700 PA

The law on five seat commercials is a bit complicated, l don't think the Grenadier qualifies.

The govt changed the rules to try and close a loophole on people buying double cabs and getting away with company car tax etc.

For all those of you who have this problem please write to Mark Harper. mark.harper.mp@parliament.uk

His is the transport secretary I believe. THe only way around this problem is a change in the rules. Some manufacturers have managed this so a little pressure applied from a hard working business owner can’t do any harm.

This is what I wrote:

Dear Mark,

I am writing to request a review of the current rules on the classification of commercial vehicles. The current rules restrict LGV’s to 3.5 tons gross weight. As vehicles have changed to meet emissions and safety regulations over the years they have inevitably got heavier. This affects their useful payload which affects productivity. The other issue now is that some of these vehicles no longer qualify for the commercial VAT reclaim and BIK reduced rate.

In order to qualify for the reduced BIK and VAT reclaim vehicles with 5 seats must either weigh less than 2050kg or be capable of carrying 1000kg. Many vans and pickups now weigh over the 2050kg. Some manufacturers have tried to get around this by selling LGV’s as ‘chassis cabs’ which are registered and delivered without any kind of load area, thus reducing their weight considerably. The load area is then added by aftermarket suppliers. Once added however this leaves them with less than the 1000kg payload, but since the vehicle was lighter when it was registered they still qualify. Ford and Iveco are two examples of this.

One vehicle that has been caught out by this is the N1 commercial INEOS Grenadier, which weighs 2600kg and has a gross weight of 3500kg. Thus meaning it does not qualify for the commercial BIK rate even though it is a commercial vehicle. I have recently bought one of these to replace a Land Rover Defender. Even though both the Defender and the Grenadier are mechanically virtually identical and do the same job pulling the same trailers, the Grenadier is treated differently by the Tax system.. This is unfair.

I understand the need to prevent luxury 4x4’s such as Range Rovers being registered as commercial to evade tax but there are smarter ways to accomplish this. The existing rules could be maintained but with an amendment to include vehicles registered as N1 commercial with solid rear axles. A solid rear axle is a good way of distinguishing between a genuine commercial vehicle and SUV’s and luxury 4x4’s.

As an example the following five seat N1 commercial vehicles have solid rear axles:

Ford Transit chassis cab

Iveco Daily chassis cab

Ford Ranger double cab

Nissan Navara double cab

Toyota Hilux double cab

Ineos Grenadier N1 Commercial

The following SUV type vehicles do not have a solid rear axle:

Land Rover Discovery

Toyota Landcruiser

BMW X5

Range Rover

There are many other SUV’s which fall into this category.

Adding N1 Commercial vehicles with solid rear axles to the category of low rate BIK and Vat reclaim would be a big help to small businesses like mine and would be fairer to those who need a 4x4 commercial capable of towing 3.5 tons.

If you would like any further information on this issue please get in touch.

Yours sincerely

His is the transport secretary I believe. THe only way around this problem is a change in the rules. Some manufacturers have managed this so a little pressure applied from a hard working business owner can’t do any harm.

This is what I wrote:

Dear Mark,

I am writing to request a review of the current rules on the classification of commercial vehicles. The current rules restrict LGV’s to 3.5 tons gross weight. As vehicles have changed to meet emissions and safety regulations over the years they have inevitably got heavier. This affects their useful payload which affects productivity. The other issue now is that some of these vehicles no longer qualify for the commercial VAT reclaim and BIK reduced rate.

In order to qualify for the reduced BIK and VAT reclaim vehicles with 5 seats must either weigh less than 2050kg or be capable of carrying 1000kg. Many vans and pickups now weigh over the 2050kg. Some manufacturers have tried to get around this by selling LGV’s as ‘chassis cabs’ which are registered and delivered without any kind of load area, thus reducing their weight considerably. The load area is then added by aftermarket suppliers. Once added however this leaves them with less than the 1000kg payload, but since the vehicle was lighter when it was registered they still qualify. Ford and Iveco are two examples of this.

One vehicle that has been caught out by this is the N1 commercial INEOS Grenadier, which weighs 2600kg and has a gross weight of 3500kg. Thus meaning it does not qualify for the commercial BIK rate even though it is a commercial vehicle. I have recently bought one of these to replace a Land Rover Defender. Even though both the Defender and the Grenadier are mechanically virtually identical and do the same job pulling the same trailers, the Grenadier is treated differently by the Tax system.. This is unfair.

I understand the need to prevent luxury 4x4’s such as Range Rovers being registered as commercial to evade tax but there are smarter ways to accomplish this. The existing rules could be maintained but with an amendment to include vehicles registered as N1 commercial with solid rear axles. A solid rear axle is a good way of distinguishing between a genuine commercial vehicle and SUV’s and luxury 4x4’s.

As an example the following five seat N1 commercial vehicles have solid rear axles:

Ford Transit chassis cab

Iveco Daily chassis cab

Ford Ranger double cab

Nissan Navara double cab

Toyota Hilux double cab

Ineos Grenadier N1 Commercial

The following SUV type vehicles do not have a solid rear axle:

Land Rover Discovery

Toyota Landcruiser

BMW X5

Range Rover

There are many other SUV’s which fall into this category.

Adding N1 Commercial vehicles with solid rear axles to the category of low rate BIK and Vat reclaim would be a big help to small businesses like mine and would be fairer to those who need a 4x4 commercial capable of towing 3.5 tons.

If you would like any further information on this issue please get in touch.

Yours sincerely

That's a very good argument. Please update with any response that you get, this issue means l currently can't buy a five seat Grenadier "Commercial" unless l register it as a private vehicle and just charge the business for use of it.

I assume one way around it would be to buy the two seat Grenadier Commercial option?

Does this then make it qualify like the Defender?

The second row seats could possibly be retrofitted. There are companies already offering second row seat conversions for the new Defender 110 Commercial

I assume one way around it would be to buy the two seat Grenadier Commercial option?

Does this then make it qualify like the Defender?

The second row seats could possibly be retrofitted. There are companies already offering second row seat conversions for the new Defender 110 Commercial

- Local time

- 2:25 PM

- Joined

- Dec 28, 2021

- Messages

- 860

The current New Defender 90 and 110 also don't qualify under the existing rules, but are usually waived by the local tax inspector after JLR lobbied the government.That's a very good argument. Please update with any response that you get, this issue means l currently can't buy a five seat Grenadier "Commercial" unless l register it as a private vehicle and just charge the business for use of it.

I assume one way around it would be to buy the two seat Grenadier Commercial option?

Does this then make it qualify like the Defender?

The second row seats could possibly be retrofitted. There are companies already offering second row seat conversions for the new Defender 110 Commercial

The Grenadier 2 seat Station wagon does not meet the letter of the law, (like the new Defender variants), but Ineos have not done any lobbying yet, so as of today, your guess is as good as mine!

Please write something similar and send it to him. The more the merrier.That's a very good argument. Please update with any response that you get, this issue means l currently can't buy a five seat Grenadier "Commercial" unless l register it as a private vehicle and just charge the business for use of it.

I assume one way around it would be to buy the two seat Grenadier Commercial option?

Does this then make it qualify like the Defender?

The second row seats could possibly be retrofitted. There are companies already offering second row seat conversions for the new Defender 110 Commercial

After extensive investigation l was told that the new Defender was Commercial in terms of BIK and VAT etc

Now l am being told that it doesn't actually qualify but in practice the tax man will accept it?

Sounds like a minefield! The Defender Commercial is definitely a van, it's got a full bulkhead, no rear windows, and two seats.

lt's a posh van granted but you couldn't say it's not a van.

The HMRC doesn't like five seat LCV's because they see them as a tax dodge and l bet this is where the problem lies.

Now l am being told that it doesn't actually qualify but in practice the tax man will accept it?

Sounds like a minefield! The Defender Commercial is definitely a van, it's got a full bulkhead, no rear windows, and two seats.

lt's a posh van granted but you couldn't say it's not a van.

The HMRC doesn't like five seat LCV's because they see them as a tax dodge and l bet this is where the problem lies.

The HMRC doesn't like five seat LCV's because they see them as a tax dodge and l bet this is where the problem lies.

Where does that leave double cab pickups? Those are commercial vehicles and have five seats.

What is very misleading is that Ineos themselves state on their web site:

"The standard five-seat Grenadier Station Wagon is certified as a commercial vehicle and is fitted with a cargo barrier, to provide the optimum balance between payload and passenger carrying capability."

That would lead a perspective buyer to believe that for both Road Fund License and HMRC perspectives that the Grenedier SW, five seat, with blanked out rear windows, is vehicle that qualifies as a Commercial vehicle.

Last edited:

The second row seats could possibly be retrofitted. There are companies already offering second row seat conversions for the new Defender 110 Commercial

The moment you do this and the HMRC ask to see your vehicle (it happens) is the moment your argument for it being a commercial vehicle comes un-stuck.

- Local time

- 7:25 PM

- Joined

- Jul 27, 2022

- Messages

- 6,005

What is very misleading is that Ineos themselves state on their web site:

"The standard five-seat Grenadier Station Wagon is certified as a commercial vehicle and is fitted with a cargo barrier, to provide the optimum balance between payload and passenger carrying capability."

That would lead a perspective buyer to believe that for both Road Fund License and HMRC perspectives that the Grenedier SW, five seat, with blanked out rear windows, is vehicle that qualifies as a Commercial vehicle.

Due diligence isn't that hard.

Walk into an agents and ask "By certified, what exactly do you mean?"

Similar threads

- Replies

- 16

- Views

- 2K

- Replies

- 0

- Views

- 1K

- Replies

- 83

- Views

- 6K

- Replies

- 99

- Views

- 9K